Inside BENEO’s new pulse plant: pioneering sustainable protein from faba beans

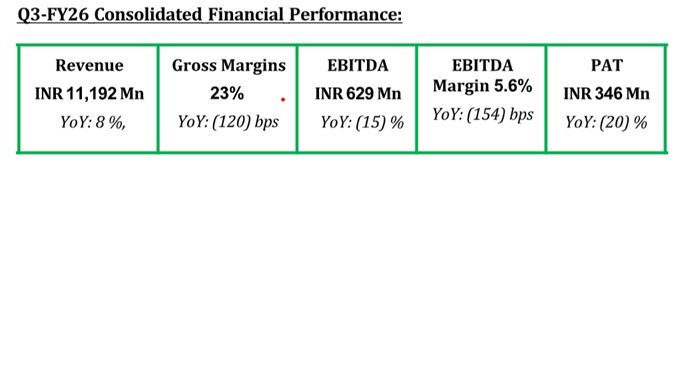

Posts EBITDA at Rs 629 M

Heritage Foods announced its results for the quarter ended December 31, 2025.

The consumer dairy business, excluding bulk-fat sales grew at 13 per cent Y-o-Y, led by value added products with a strong growth of 13.8 per cent. Value-added products including consumer fats, like ghee and butter, grew at an impressive 22.6 per cent, reaching a contribution of 38.4 per cent of overall revenues. B2B bulk fats business de-grew 98 per cent YoY in the quarter.

Value-added product volumes grew 6.8 per cent YoY, with almost all VAP categories delivering positive volume growth despite higher-than-normal rainfall, and prolonged periods of below-average temperatures during the quarter.

Volume growth was led by curd (+6 per cent) crossing 400 tonne per day for the first time in Q3 of a year. Paneer continued its impressive growth at 25 per cent, alongside strong traction in ice-creams growing at 18 per cent, and drinkables with lassi up 29 per cent and milkshakes up 36 per cent.

A calibrated 4.9 per cent price hike and improved product mix offset higher input costs while sustaining 7 per cent blended volume growth. Net milk realisation increased by Rs 2.67 per litre YoY (up 4.9 per cent), reflecting resilient demand and brand equity.

Brahmani Nara, Executive Director, said, “Q3 FY26 was characterised by an exceptionally tight industry supply environment, marked by milk shortages, elevated procurement costs, and heightened competitive intensity. Despite these challenges, Heritage Foods delivered 8 per cent topline growth, supported by strong execution, disciplined cost management, and sustained momentum in our value-added portfolio. Consumer business led by Value-added products continued to perform well during the quarter, with broad-based volume growth across categories, even amid adverse weather conditions. Strength in curd, paneer, drinkables, ghee and ice-creams reflects the resilience of consumer demand, the strength of our brands, and the effectiveness of our market expansion and engagement initiatives.”

Nara added, “While procurement volumes were impacted by supply-side constraints during the flush season, sequential stabilisation and improved mix underscore our focus on disciplined procurement in a volatile input cost environment. We remain focused on strengthening our core markets through sharper route-to-market execution, targeted brand investments, and new product interventions. Looking ahead, the commissioning of our ice cream and flavoured milk capacities in Q4 FY26 positions us well to capture incremental demand and support VAP-led growth. With improving supply conditions, continued premiumisation, and a strong innovation pipeline, we remain

confident of delivering sustainable growth while staying true to our commitment towards consumers, farmers, and all stakeholders.”