Inside BENEO’s new pulse plant: pioneering sustainable protein from faba beans

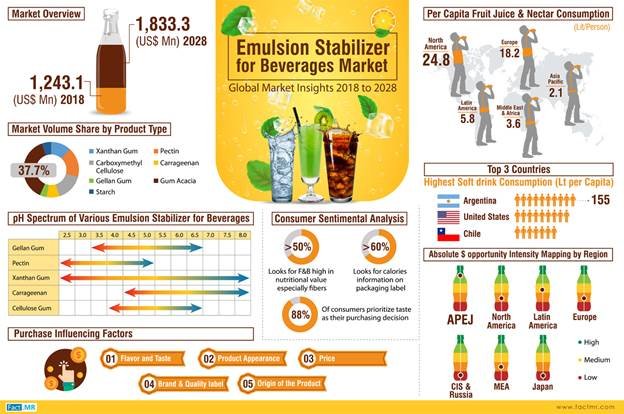

Global consumption of emulsion stabilizer for beverages is foreseen to surpass 210,000 MT in 2018, up from nearly 200,000 MT in 2017, as per Fact.MR valuation. The market is poised to grow at a moderate CAGR of 4% during the forecast period 2018-2028.

Buoyancy in the global food and beverage industry is likely to contribute to the steady growth of the market. Owing to the presence of a huge number of small market players, the marketplace remains highly fragmented. Fact.MR estimates that the emulsion stabilizer for beverages market will surpass US$ 1.8 Billion by the end of 2028.

Apart from their popular use as an emulsifier, F&B sector uses emulsion stabilizers for multiple functions such as texture integrity, viscosity modifications, and taste preservation. Owing to their high vulnerability to spoilage, beverage industry highly consumes emulsion stabilizers.

The study shows that gum acacia remains the highly preferred emulsion stabilizer among beverage manufacturers owing to over 3-fold price difference when compared with other counterparts such as pectin, gellan gum and carrageenan. Global consumption of gum acacia is expected to reach nearly 105,000 MT and account for about 35% of the total consumption by 2028.

With its superior physio-chemical characteristics, pectin is estimated to register the second largest demand for emulsion stabilizer during the forecast period. In terms of value, pectin will report the largest revenues worth over US$ 730 Million by the end of 2028. 3-fold higher prices of pectin can be attributed to the greater market revenues despite gum acacia’s highest consumption.

The study opines that application of emulsion stabilizers remains highly concentrated in the UTH soy beverages and dairy beverages wherein emulsion stabilizers are used for their stability under low pH and high-temperature treatments.

Beverage manufacturers persistently seek beverage formulators for establishing commercial formulations of beverages which can be easily reproduced for mass production. The marketplace continues to witness demand for individual stabilizers and blends or mix of stabilizers.

In a bid to optimize raw material cost, beverage manufacturers seek stabilizer blends wherein better performance is obtained by mixing properties of premium and low-cost stabilizers. Demand for individual and stabilizer blends remains highly concentrated in the carbonated soft drinks. The study predicts that carbonated soft drinks will continue to register leading demand for emulsion stabilizers. By 2028, carbonated soft drinks are expected to hold over 28% of the market revenue. Plant-based beverages are projected to report the second largest demand for emulsion stabilizers and, with demand likely to reach nearly 70,000 MT by 2028 end.

Fact.MR estimates that APEJ will continue to register the highest demand throughout the forecast period. With the flourishing food and beverage industry, the region is home to a few of the leading F&B companies. Improving economy and urbanization have increased the discerning consumer base in the region. These changing demographics in APEJ, according to the study, are likely to generate revenues worth US$ 500 Million by the end of 2028. Europe and Latin America are expected to register steady demand and collectively account for over 30% market share by 2028 end.

Manufacturers that are aware of the evolving trend in the beverage industry are engaged in M&A, expansion and partnership activities with an aim to expand their global footprints. The Fact.MR study offers analysis on the key developments in the emulsion stabilizer for beverages market. For instance, Cargill has invested about US$150 Mn to build a new plant in Brazil in 2019 for the production of pectin.

In March 2018, Tate & Lyle Plc has partnered with HORN, North America’s premier distributor of specialty ingredients and raw materials. In August 2017, Ingredion acquired TIC Gums Inc., a leading provider of advanced texture systems with an aim to enhance their product offerings.

Foraying into the clean label venture is another prominent strategy adopted by emulsion beverage manufacturers. DowDuPont launched clean label GRINDSTED GELLAN MAS 100 a gelling ingredient for beverage manufacturers to produce clean label soy, almond and other plant-based beverages.