Inside BENEO’s new pulse plant: pioneering sustainable protein from faba beans

In September 2022, Indian FMCG company Dabur India entered the spices market with the launch of Dabur Hommade Tasty Masala. Less than a year later, in January 2023, the company acquired 51 per cent equity stake in Badshah Masala Private Limited, a prominent, domestic producer, marketer, and exporter of powdered spices and seasonings. The deal was worth Rs 5,87.52 crore ($71.2 million). This acquisition provides Dabur India with a foothold in the Indian packaged herbs, spices and seasonings market, valued at $1.5 billion. Additionally, Badshah Masala will be able to expand the domestic and export base for its spices, according to GlobalData, a leading data and analytics company.

The Indian market for packaged Indian herbs, spices and seasonings is fiercely competitive, with numerous domestic brands and private labels vying for retail shelf space. In order to target cost-sensitive mass retail consumers, companies often compete on price. However, media reports on adulterated spices have led to a growing demand for authentic and high-quality powdered spices and seasonings among higher-income urban households. According to market research firm ResearchAndMarkets, the Indian spices market was valued at Rs 142,569.3 crore in 2021. It expects the market to grow at a Compound Annual Growth Rate (CAGR) of 11.29 per cent during the period of 2021-2027, reaching a value of Rs 270,928.4 crore by 2027.

Bobby Verghese, a Senior Research Analyst, at GlobalData, notes, “Owing to the extensive use of spices in local cuisine, India is the world’s largest consumer and one of the largest producers of herbs, spices and seasonings. Indians traditionally purchase fresh spices and seasonings in loose form from open markets and local spice shops and grind them at home or local mills. However, the demand for packaged spices and seasoning products is surging, catalysed by rapid urbanisation, a booming organised retail sector and new product launches in convenient formats, supported by intense marketing campaigns.”

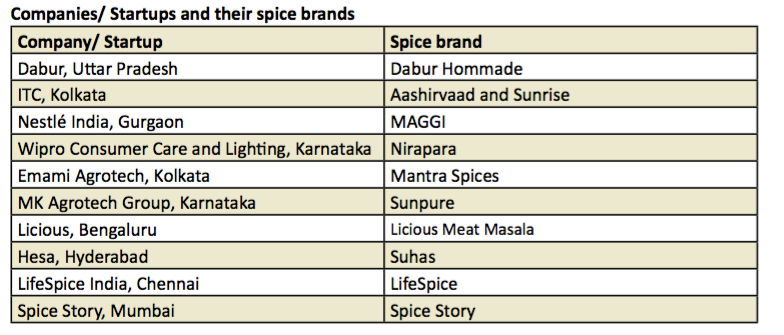

As a result of this trend, a portion of the untapped unorganised spices market is also attracting local and multinational companies, including domestic Consumer Packaged Goods (CPG) heavyweights such as Tata Consumer Products with its Tata Sampann brand, and ITC, with its Aashirvaad brand.

In addition to its existing foothold in the Indian spices market, FMCG player ITC has been experiencing strong growth. Recently, the company invested Rs 200 crore to launch its internationally benchmarked spices plant in Palnadu, Andhra Pradesh. This state-of-the-art mega facility boasts processing lines for turmeric, chilli, and blended spices, with an annual capacity of 20,400 MT of spices. The plant will have the capacity to produce over 15 organic spices and is expected to boost ITC’s food exports globally, with target markets including Europe, the US, Canada, Australia, and China, among others. The new plant will also support a sustainable spices value chain and extend support to farmers through a robust crop development programme, ensuring traceability.

“We have customised our products in line with the regional tastes and preferences and have adjusted the delivery on the key parameters in terms of pungency, volatile oils, aroma and the core ingredients itself. Going forward, the idea is to take the regional specialities to newer markets. We are also looking at introducing new culinary solutions in Western cuisine,” said Ganesh K Sundararaman, Strategic Business Unit (SBU) Chief Executive, Staples, Snacks and Meals, Foods Division, ITC.

Another major player in the food industry, Nestle India, has also been working to strengthen its MAGGI noodles line with the addition of spices. To support the economic stability of spice farmers, Nestlé MAGGI has implemented a Sustainable Sourcing Programme for spices. The programme is founded on the principles of traceability and responsible sourcing, and aims to ensure transparency in the origins of spices, while progressively delivering positive impacts for farmer communities, the environment, and the business within its spices supply chain. The MAGGI Spice plan is focused on tracing seven key spices – Chilli, Turmeric, Coriander, Cumin, Aniseed, Fenugreek, and Nutmeg – used in MAGGI products. The key areas of intervention include ensuring good soil health, reducing water wastage, eliminating pesticide residues, improving the economics of cultivation, and enhancing biodiversity on spice farms.

Commenting on the thought behind this programme, Suresh Narayanan, Chairman and Managing Director of Nestlé India, said, “Spices are important for India, for Indians, and hence for the MAGGI portfolio. At Nestlé India, we have always aimed to create value for our stakeholders, especially for the communities in which we operate. The programme is built on three aspects: planet, people, and profits (for farmers). Through this, we wish to contribute to improving the livelihood of spice farmers by introducing them to the best farming practices that are sustainable and will help them grow the best produce while ensuring safe living and working conditions for them.”

Why the bets on spices are heating up?

Apart from Dabur, ITC, and Nestle, many Indian brands have been venturing into the spice market in the past 2-3 years. Spices have become a must-have offering for most Indian FMCGs and food businesses.

In December 2022, Wipro Consumer Care and Lighting signed a definitive agreement to acquire Nirapara, one of the top-selling packaged food and spice brands from Kerala, owned by KKR Group of Companies. This move comes after Wipro’s announcement of its foray into the food business in India and its ambition to become a significant player in the snack food, spices, and ready-to-cook market.

“Nirapara is our 13th acquisition. This acquisition gives us a clear foothold in the spices and ready-to-cook segment in India. We are excited to enter a large segment that is expected to grow rapidly,” said Vineet Agrawal, CEO, Wipro Consumer Care and Lighting, and Executive Director of Wipro Enterprises.

Kolkata-based Emami Agrotech, the branded food manufacturing arm of the diversified business conglomerate Emami Group, launched Mantra Spices under its widely popular Emami Healthy and Tasty brand. Emami Agrotech has curated the Mantra Masala range with a wide variety of pure spices in expansive categories, including Haldi (Turmeric), Mirch (Chilli), Jeera (Cumin), and Dhaniya (Coriander) powders, as well as blended spices like Garam Masala, Meat Masala, Chicken Masala, Pav Bhaji Masala, Chhole Masala, Chaat Masala, Sabji Masala, and Hing. Other spices like Sambar Masala and Kashmiri Lal Mirch will be added soon. The company plans to introduce Tastemakers in the national market in the next phase.

Commenting on the launch of the new category, Krishna Mohan Nyayapati, Director, Emami Agrotech said, “Following the successful West Bengal launch of Mantra Spices, this is a critical step for Emami Healthy & Tasty to strengthen its presence in the national market. We plan to expand our footprint across two lakh retail outlets by the end of this year and five lakh outlets in the next three years and will have a significant presence in modern trade and e-commerce channels. We are also bullish about achieving our revenue target of Rs 700 – 1000 crore in the next five years for Mantra.”

Another big name on the list is Sunpure, a renowned South Indian edible oil brand and part of the MK Agrotech Group, which has recently expanded its product line to include spices. The brand has launched three new products, Sunpure Red Chilli Powder, Sunpure Turmeric Powder, and Sunpure Coriander Powder, and plans to introduce blended spice mixes soon. Sunpure’s spices are carefully processed to retain their bioactive components, such as capsaicin in chilli, curcumin in turmeric, and essential oil in coriander. The spices are carefully graded, scientifically processed, and hygienically packed, adhering to the quality parameters of the Food Safety Standard Authority of India (FSSAI), Good Manufacturing Practice (GMP), and Good Hygiene Practice (GHP). Sunpure’s commitment to these standards ensures the quality and safety of their products throughout the food supply chain.

Startups’ contribution

While India is already experiencing a surge of established players in the spice aisle, a good amount of traffic is concurrently incoming from the startups as well. Many are exploring the market for the first time, whereas, others are looking to strengthen their existing spice portfolio, creating a vibrant and competitive atmosphere.

Bengaluru-based meat startup Licious has recently entered into the spice segment with its new range of Meat Masalas. With this latest category expansion, the brand has introduced eight expertly crafted classic masalas for consumers. The range includes Asli Garam Masala, Classic Chicken Masala, Classic Meat Masala, Khansama Biryani Masala, Original Tandoori Chicken Masala, Shandaar Butter Chicken Masala, Chatpata Fish Fry Masala, and Dakshin Pepper Fry Masala. Licious aims to build this category to over Rs 300 crore within the next five years.

Speaking about expanding the brand’s offering with this new range, Vivek Gupta, Founder of Licious, said, “Licious’ latest foray into masalas aligns with the company’s strategy of portfolio diversification leveraging its strong core brand equity. We have observed a shift in consumption patterns, with consumers wanting to recreate authentic recipes within the comfort of their homes. With our specially crafted classic meat masalas, we want to offer our consumers the convenience of enjoying these authentic meat preparations. We are confident that consumers will truly relish this new offering and choose the perfect match for their most loved meat dishes.”

Hesa, a rural marketplace headquartered in Hyderabad, has recently launched a new household consumer brand called SUHAS, which offers a wide range of kitchen spices and other essential ingredients such as lentils and grains. Hesa’s focus on enabling transactions, promotions, and access has made it the largest rural marketplace in India, and now they are foraying into a new category to strengthen their consumer portfolio. With SUHAS, Hesa aims to preserve the Indian heritage of spice and provide consumers with natural, chemical-free ingredients.

“Working in rural India for more than a decade, we discovered the consumer need for quality and affordable spices. With Suhas going forward we plan to directly procure produce from Farmer Interest Groups (FIGs), Farmer Producer Organisations (FPOs), and other agri groups in the future. The idea is to elevate the earning potential of the farmers without any additional cost. Hesa aims to bolster its commitment of empowering rural India by addressing the challenges of branding and market access through Suhas,” said Vamsi Udayagiri, Founder and CEO of Hesa.

The Indian spice industry is being bolstered by established players such as Chennai-based startup LifeSpice India and a Mumbai-based startup Spice Story. These companies have made commendable efforts to strengthen the industry. Recently LifeSpice made waves by launching India’s first science-backed spice mixes. The startup conducted pre-clinical level in vivo tests on Zebrafish to establish that spices contain phytochemicals such as Oleanole, Anethole, Cineole, Piperine, Capsaicin, Curcumin, Cuminaldehyde, Cuminum, which, when consumed in optimal combinations, can upregulate human genes and help fight heart ailments, cancer, diabetes, cholesterol and asthma. The company has already received one patent, and three more are in the pipeline.

On the other hand, Spice Story has raised an undisclosed amount of pre-series A funding from Agility Ventures, Maxar.vc, Nafa capital and select leaders from the FMCG industry, including Anupam Bokey and Anand Dhodapkar. The raised capital will be primarily utilised to strengthen the brand’s distribution network and expand its presence on online platforms. Previously, the company had raised a seed round in January 2021. Since then, it has grown threefold and aims to achieve 25 times growth over the next three years.

Moreover, in its pursuit of offline expansion, the startup has entered into a partnership with Jayanti Herbs and Spice, a Bengaluru-based supplier of herbs and spices. This partnership will enable Spice Story to tap into Jayanti Herbs and Spice’s extensive distribution network, which consists of over 23,000 multi-brand modern format retail stores, including national and regional chains, as well as standalone modern retail stores.

Speaking on the development, Soumyadeep Mukherjee, Founder & Chief Executive Officer of Spice Story said, “This is a partnership we look forward to not only from a business augmentation point of view but because both organisations have a lot in common in terms of thought-process and vision. Both brands have a Consumer First approach with convenience at its core. It would also help in strengthening our product development strategy.”

The $10 billion spice export target

At the 35th-anniversary event of the Spices Board of India in 2022, Piyush Goyal, Union Minister of Commerce & Industry, Consumer Affairs, Food & Public Distribution and Textiles urged the Spices Industry to double its sector exports to $10 billion within the next five years. However, the question arises: how achievable is this goal and is India equipped to meet this target? Let’s take a closer look.

According to recent statistics, India’s spice exports have shown astonishing growth, with a 115 per cent increase in volume and 84 per cent increase in value ($) between 2014 and 2021. In the 2020-21 fiscal year, exports reached an all-time high of $4.2 billion, and Indian spices & spice products are now available in over 180 countries worldwide. During the COVID-19 pandemic, India’s traditional medicinal practices, such as the use of spices in Ayurvedic products like Ayush Kwath (which contains cinnamon, tulsi, dry ginger and black pepper), and Golden Milk (made with turmeric and pepper), gained global recognition for their immune-boosting properties. As a result, turmeric exports from India increased by 42 per cent in 2021.

The Spice Board of India is taking concerted action by partnering with several national and international agencies to launch various projects and initiatives that are driving growth in the Indian spice industry. These include collaborations with:

1. The Standards and Trade Development Facility (STDF) of WTO and FAO, aimed at strengthening the spice value chain in India and improving market access through capacity building and innovative interventions.

2. The Quality Council of India for INDGAP (Good Agricultural Practices) Certification.

3. The spice industry and international agencies such as IDH and GIZ in Germany on the National Sustainable Spice Programme.

4. The UNDP’s Accelerator Lab, India, for the development of blockchain enabled traceability platform for spices.

These collaborative efforts are contributing significantly to the development and expansion of the Indian spice industry.

Moreover, the Spice Board of India’s Quality Evaluation Laboratory network provides analytical services to exporters and other stakeholders across the major ports of India. Currently, the Spice Board runs state-of-the-art labs at eight locations, including Kochi in Kerala, Guntur in Andhra Pradesh, Tuticorin and Chennai in Tamil Nadu, Mumbai in Maharashtra, Kandla in Gujarat, Narela near Delhi, and Kolkata in West Bengal.

The Spices Board has implemented several digital programmes, including a cloud-based live e-auction system for small cardamom, to promote transparency and facilitate ease of doing business. Most of the Board’s services are now digitised and available online. Recently, the Board launched Spice Xchange India, a first-of-its-kind online portal exclusively dedicated to spice trade. The portal utilises Artificial Intelligence tools to facilitate B2B matchmaking between spice exporters and importers worldwide. By connecting Indian exporters and global buyers through a technology-linked platform, the portal has significantly strengthened the export transactions of spices from India. The Spice Xchange India is a giant leap towards promoting the ease of doing business in the spice industry.

Although India is a global leader in the spice industry, it is not without its challenges. During a discussion on the sector’s issues, Piyush Goyal stated, “when it comes to export of spices in whole raw form, we do not currently enjoy cost advantage over many countries in Asia and Africa regions, which means we should focus on increasing the export of value-added spice products. Also, we face challenges in preparing our production system and manufacturing systems to meet stringent quality and food safety standards. Our aim should be to maintain the competitive edge of the Indian spice industry with added thrust on high-end value addition and new product development so as to cater to the specific requirements of varied consumers around the globe, while committed to ensuring food safety, quality, and sustainability.”

India has long held a top position in the global spice industry, serving as a leading producer, consumer, and exporter of spices and spice products while also being a global hub for spice processing and value addition. The government and industry players have taken proactive measures to further enhance the sector’s growth. Hence, if the challenges of quality, safety, and regulation can be effectively addressed, achieving the $10 billion export target within the next five years is a realistic goal.

Mansi Jamsudkar